This company-wide effort crosses multiple functional areas and is reinforced by critical project management and a strong technology infrastructure. It’s time to embrace modern accounting technology to save time, reduce risk, and create capacity to focus your time on what matters most. To respond and lead amid supply chain challenges demands on accounting teams in manufacturing companies are higher than ever. Guide your business with agility by standardizing processes, automating routine work, and increasing visibility.

Funding instruction for Afghan schemes: hotel and temporary … – GOV.UK

Funding instruction for Afghan schemes: hotel and temporary ….

Posted: Thu, 17 Aug 2023 14:40:52 GMT [source]

The temporary accounts of a sole proprietorship are closed to the owner’s capital account. It zeroes out the temporary account balances to get those accounts ready to be used in the next accounting period. In accounting, temporary accounts are used to record financial transactions for a particular accounting period.

Other examples of permanent accounts are—asset, liability, equity, accounts payable, inventory, and investments. A temporary account that is not an income statement account is the proprietor’s drawing account. The balance in the drawing account is transferred directly to the owner’s capital account and will not be reported on the income statement or in an income summary account. All of the income statement accounts are classified as temporary accounts. A few other accounts such as the owner’s drawing account and the income summary account are also temporary accounts.

Conclusion – Which is Not A Temporary Account in Accounting? – Understanding Temporary and Permanent Accounts

If you’re looking for information on what application would be right for your business, be sure to check out The Ascent’s accounting software reviews. Organizations use liability accounts to record and manage debts owed, including expenses, loans, and mortgages. Your success is our success.From onboarding to financial operations excellence, our customer success management team helps you unlock measurable value. Through workshops, webinars, digital success options, tips and tricks, and more, you will develop leading-practice processes and strategies to propel your organization forward. F&A leadership can have a significant impact by creating sustainable, scalable processes that can support the business before, during, and long after the IPO.

BlackLine’s foundation for modern accounting creates a streamlined and automated close. We’re dedicated to delivering the most value in the shortest amount of time, equipping you to not only control close chaos, but also foster F&A excellence. Integrate with treasury systems to facilitate and streamline netting, settlement, and clearing to optimize working capital. Centralize, streamline, and automate intercompany reconciliations and dispute management.Seamlessly integrate with all intercompany systems and data sources. Automatically identify intercompany exceptions and underlying transactions causing out-of-balances with rules-based solutions to resolve discrepancies quickly. Make the most of your team’s time by automating accounts receivables tasks and using data to drive priority, action, and results.

Defining Temporary Accounts – What is a Temporary Account?

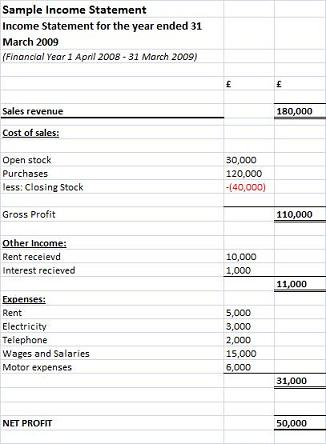

This ensures accurate financial reporting and helps Company ABC make informed decisions. A temporary account is an account that begins each fiscal year with a zero balance. At the end of the year, its ending balance is shifted to a different account, ready to be used again in the next fiscal year to accumulate a new set of transactions. Temporary accounts are used to compile transactions that impact the profit or loss of a business during a year. The balances in these accounts should increase over the course of a fiscal year; they rarely decrease. The balances in temporary accounts are used to create the income statement.

- Purchases account is a temporary account used to record the cost of goods or materials purchased by a business during an accounting period.

- Transactions may sometimes seem to blur the lines between categories.

- Quarterly temporary accounts are useful for monitoring financial success and tax payments.

- Temporary accounts in accounting are used to record financial transactions for a specific accounting period.

- These accounts are set to zero at the start of each accounting period and are closed at its end to maintain an accurate record of accounting activity for that period.

- Lastly, since most organizations use accrual-based accounting systems, they must transfer any unused amounts held in a temporary account into another account once the period has expired.

Both types of accounts are essential components of the double-entry bookkeeping system, with each transaction affecting at least two accounts. Once the fiscal year closes, all the accounts representing the transactions of the business for that year are summarized into the Balance sheet. These include various assets, liabilities, owner’s equity, retained earnings, etc. While assets, liabilities & capital directly represents the going concern of the business, they remain in the balance sheet along with the company’s existence.

Examples of temporary accounts

Firstly, temporary accounts typically only exist for one year or less. As such, they are often seen as disposable and less critical than permanent accounts, which can remain open for extended periods. Temporary account categories include sales revenues, cost of goods sold, operating expenses, payroll expenses, and income tax expenses.

For instance, businesses can track their gains and losses in a temporary account to calculate the profit or loss over a certain period and then be closed out after correctly reporting the information. When comparing temporary vs. permanent accounts, two important things come to mind. In fact, many small business owners find it easier to reset their accounts so the opening balance at the start of the year is zero. You may also choose to create a temporary income summary account, which helps with the end-of-the-year closing process.

Resources created by teachers for teachers

Revenue refers to the total amount of money earned by a company, and the account needs to be closed out at the end of the accounting year. To close the revenue account, the accountant creates a debit entry for the entire revenue balance. For example, if the total revenue recorded was $20,000, then a debit entry of the same amount should be written in the revenue account.

- Now that we understand the basic differences between temporary accounts and permanent accounts, let’s delve into the six key differences that set them apart.

- At the end of a fiscal year, the balances in temporary accounts are shifted to the retained earnings account, sometimes by way of the income summary account.

- This ongoing record provides a comprehensive view of the company’s financial position.

The specific types of revenue accounts include sales accounts, profit statements, interest income accounts, and more. The information recorded in these temporary accounts is vital for understanding the overall health of a business. They help accountants determine net income and other essential metrics, which allows them to measure a company’s performance over time. In addition, these temporary accounts provide critical information that external auditors use to assess the accuracy of a business’s financial reports.

BlackLine partners with top global Business Process Outsourcers and equips them with solutions to better serve their clients and achieve market-leading automation, efficiencies, and risk control. By outsourcing, businesses can achieve stronger compliance, gain a deeper level of industry knowledge, and grow without unnecessary costs. Global and regional advisory and consulting firms bring deep finance domain expertise, process transformation leadership, and shared passion for customer value creation to our joint customers.

These flows of cash can significantly impact the implementation of an investment mandate, objective, or strategy. Petty cash is often managed by one individual, who will have a specific budget assigned to them. They can already use this money at their discretion, usually without receipts. On the other hand, if you sign an open-ended lease or decide Temporary accounts to become a homeowner, your rent payments could become permanent fixtures in your budget. For tenants who sign a fixed-term lease, their rent payments are only temporary since they will eventually stop paying them once the lease expires. This agreement usually lasts six months or longer and allows tenants to move elsewhere when their lease ends.

While a permanent account indicates ongoing progress for a business, a temporary account indicates activity within a designated fiscal period. Tracking the amount of money received for goods and services provided, revenue accounts include interest income and sales accounts. A few examples of sub-accounts include petty cash, cost of goods sold, accounts payable, and owner’s equity. Finally, a corresponding credit entry of $5,000 will be entered into the retained earnings account (a permanent account), which shows the net income of the business for that particular point in time.

Permanent accounts are asset accounts, liabilities, and equity accounts you’ll see on the balance sheet. By zeroing out these accounts, companies ensure funds earned in one fiscal year do not carry over into a new fiscal year. This includes short-term debts, such as accounts payable or wages payable, and long-term liabilities, such as loans or mortgages payable. Otherwise, these funds will create a discrepancy in the general ledger, resulting in miscalculations across other accounts. A business owner can withdraw money for personal use with a drawing account. Sole proprietorships, partnerships, or S-corps typically use drawing accounts.

For example, a bookkeeper may enter the data into a printed spreadsheet (manual entry) or use online tools like Google Spreadsheets, Microsoft Excel, or other free and paid online accounting tools. A temporary new account is a holding place set up within a fund to hold a balance as a result of a significant cash inflow or outflow to the fund. The account is set up to temporarily hold these funds until they can be distributed to unitholders, used to acquire additional assets for the fund, or for other large fund expenditures.

Understanding permanent and temporary accounts can help firms create budgets that accurately reflect their present condition and objectives. Temporary accounts (or nominal accounts) are accounts that you close at the end of an accounting period. This means you don’t carry their balances over to the start of the next period. They help you track your performance in a given accounting cycle and determine whether or not you’re meeting your short-term business goals.

OTR10070 – Orchestra Tax Relief: Temporary uplift – HMRC internal … – GOV.UK

OTR10070 – Orchestra Tax Relief: Temporary uplift – HMRC internal ….

Posted: Mon, 24 Apr 2017 07:00:00 GMT [source]

Understanding these challenges is critical for effective financial management and accurate financial reporting. In accounting, there are primarily five types of accounts—assets, liabilities, equity, revenue, and expenses. These can be further categorized as temporary accounts and permanent accounts. Temporary accounts are reset to zero by transferring their balances to permanent accounts. Starting an accounting period with a zero balance enables businesses to monitor activity for a specific accounting period without mixing up data from two different time periods.

Permanent accounts are defined as accounts that remain open accounts throughout a business period. At the end of a fiscal year, the accountants note the balance, but they do not close the account by zeroing it out. For example, the inventory balance from one year-end becomes the following year’s inventory balance. Likewise, the accounts payable balance shows the balance of your unpaid expenses. It does not show how much you’ve spent over the last quarter or year. It is categorized as a permanent account, alongside Notes Payable, Loans Payable, Interest Payable, Rent Payable, Utilities Payable, and other sorts of payables.

Sales, Service Revenue, Interest Income, Rent Income, Royalty Income, Dividend Income, Gain on Sale of Equipment, and other revenues or income accounts are all transitory accounts. As a result, income statement accounts are transient and must be closed on a regular basis. After this entry, your capital/retained earnings account balance would be $700. In this case, you will need to credit your business expenses account in order to zero it out, since a credit will decrease an expense account balance. To understand why you should use temporary accounts, consider this example. While both types of accounts are essential for financial accounting and have some similarities, they serve different purposes.